The Maryam Nawaz Easy Home Loan 2026 program, officially named “Apni Chhat Apna Ghar,” is revolutionizing affordable housing in Punjab. Launched under the Chief Minister’s initiative, this scheme offers interest-free loans of up to Rs. 1.5 Million for low and middle-income families to build their homes. As of January 2026, the program aims to complete over 100,000 houses, making it one of Pakistan’s most ambitious housing projects.

Features of the Maryam Nawaz Easy Home Loan 2026

The Easy Home Loan is designed for affordability, transparency, and convenience. Key features include:

- Loan Amount: Up to Rs. 1,500,000 for house construction.

- Interest Rate: 0% – pay back only the principal.

- Monthly Installments: Around Rs. 14,000, less than average rent in most cities.

- Grace Period: First 90 days free, allowing borrowers to start construction without immediate payments.

- Repayment Tenure: Flexible 7–9 years to ease financial pressure.

This structure ensures families can build homes without falling into debt traps, making it a milestone in Pakistan’s housing finance history.

Eligibility Criteria for 2026 Home Loans

Applicants must meet provincial guidelines to qualify for the 2026 Maryam Nawaz Easy Home Loan:

- Residency: Must be a permanent Punjab resident (verified via CNIC).

- Land Ownership:

- Urban areas: Plot size between 1–5 Marlas.

- Rural areas: Plot size between 1–10 Marlas.

- Income Limit: Monthly family income should preferably be under Rs. 60,000.

- Financial Record: Applicant must not have bank defaults.

- Poverty Score: Priority given to applicants with a PMT score ≤ 60 in NSER/PSER database.

Following these criteria ensures transparency and benefits the families most in need.

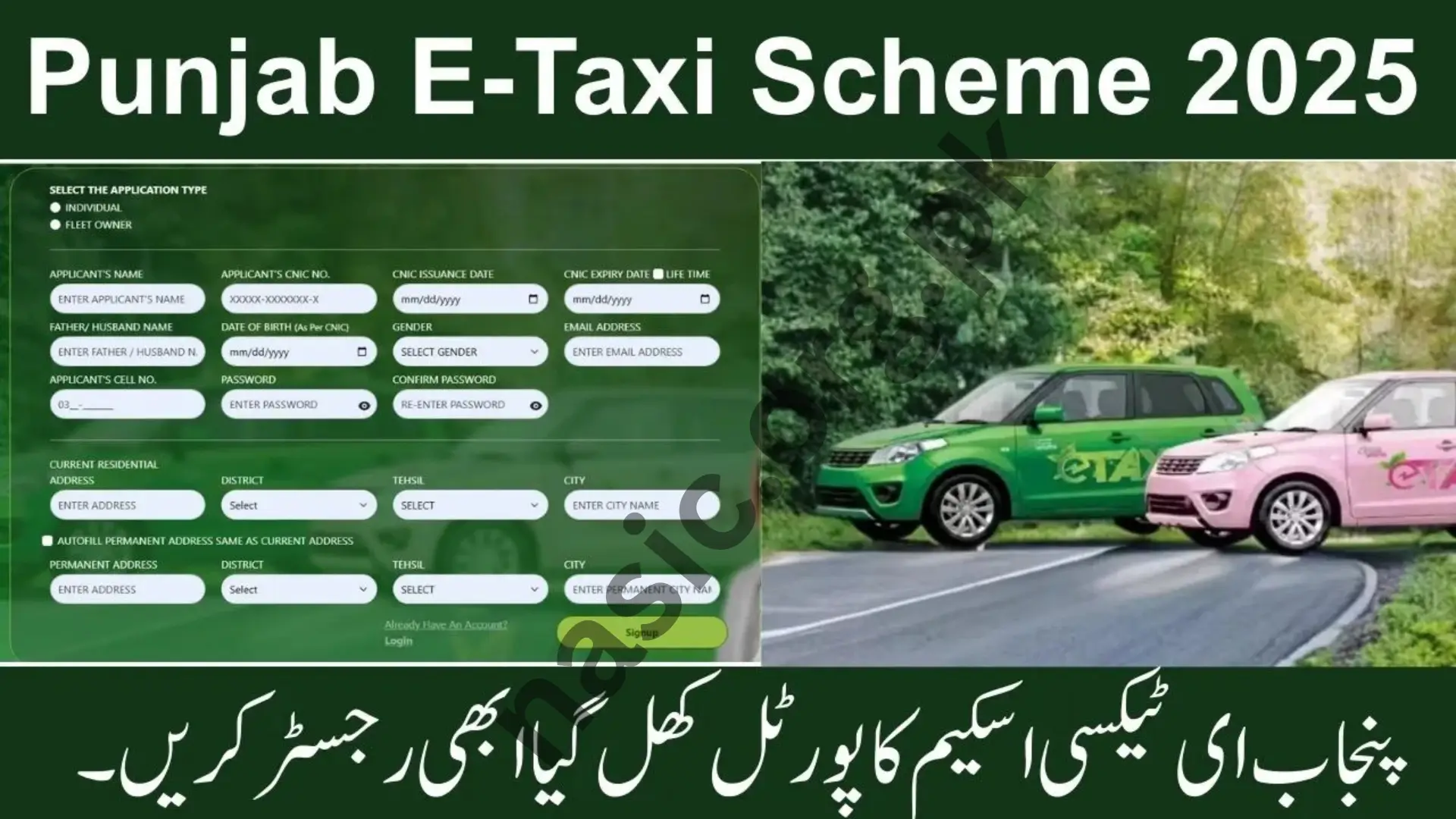

How to Apply Online: Step-by-Step

The application process is fully digital to guarantee merit-based selection and transparency. Follow these steps:

- Visit the Official Portal: Navigate to acag.punjab.gov.pk.

- Register: Click the “Registration” button and provide CNIC, mobile number, and email.

- Complete Profile: Fill personal and family details, including current address.

- Upload Documents:

- CNIC copy

- Proof of plot ownership (Registry, Fard, or Allotment Letter)

- Recent plot photographs

- Submit Application: Verify details and submit. Receive a tracking ID via SMS from 8070.

Tip: Registration is completely free; avoid paying agents or consultants.

Loan Execution Models

The 2026 program is flexible, offering three models tailored to different needs:

- Self-Construction: Interest-free loans for those already owning land (most popular).

- Private Housing Schemes: Subsidized loans for purchasing homes in approved private developments.

- State Land Projects: Construction of apartments or small houses on government land in major cities like Lahore, Faisalabad, and Multan.

These models cater to urban and rural families alike, expanding homeownership opportunities across Punjab.

Latest Updates – January 2026

- Balloting: Monthly computerized balloting selects applicants fairly.

- Phase II Success: Over Rs. 8.5 Billion disbursed to 9,000+ beneficiaries.

- Quota Expansion: Joint family applications allowed on ancestral land.

- Official Caution: No fees are required; all official notifications come via 8070 or the ACAG portal.

These updates reflect the program’s rapid growth and commitment to interest-free housing.

Conclusion

The Maryam Nawaz Easy Home Loan 2026 is a landmark initiative for affordable housing in Punjab. With interest-free loans, flexible repayment plans, and easy online application, this program provides a genuine path for low and middle-income families to achieve homeownership. Always ensure you apply through official channels to avoid scams and secure your dream home safely.